Time to end Tony Abbott’s deceitful debt scare campaign

Let’s get real here and start talking facts. Cold hard incontrovertible facts.

I have already outlined the truth of the situation in, Facts speak for themselves, Australia still lucky country. Now to get into the details.

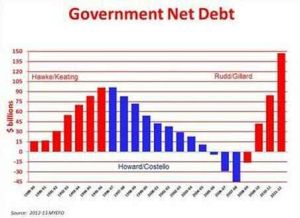

$44 billion worth of net assets were inherited by the Labor Government in 2007 from John Howard’s Liberal Government.

This is after a strong period of economic growth and private investment following the dot com crash, from 2002 to 2007. Not to mention, ever surging commodity prices and resources demand, mainly from a booming China.

$70 billion of government owned assets were sold off under by Treasurer Costello, most of them at bargain basement rates. Incidentally, as an aside, he now wants the Queensland Government to engage in such reckless practices.

This means the net assets on the books (63% of the overall

cash generated from asset sales) were as a result of selling our assets,

without a mandate, for much less than they would now be worth if they

had been retained.

Almost every other benefit from the mining boom was squandered, as

there was abysmal investment in education, health, infrastructure

and productivity over 11 ½ years of Coalition rule.

The IMF (International Monetary Fund) recently stated Howard was the most profligate Australian Prime Minister in history. If you take issue with that statement, talk to the experts.

Howard was defeated when there were very few signs of the credit crunch and GFC in evidence.

Since Labor came to power in late 2007, there has been $160 billion

in tax receipt write-downs as a result of a weaker global economy.

Between 2004 to 2007 the Howard Government saw $334 billion of upward

revisions yet still under invested in crucial sectors and sold off

public assets.

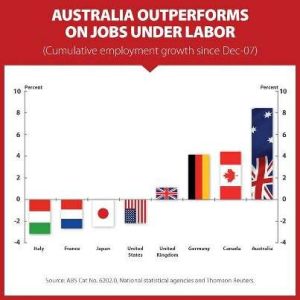

Every developed nation entered recession . . . except for Australia that is.

Australia took decisive action to stem the impacts of the GFC on jobs

and economic growth. The economy is now at trend growth and 926,000

jobs have been created since the GFC. An outstanding result no matter

how you slice it.

This meant stimulating the economy with a significant stimulus

package of around $52 billion (3% of GDP in today’s terms). A response

that was heralded as a model targeted and effective response by the IMF,

OECD and World Bank. The OECD praised the package stating it would save 200,000 jobs.

World experts such as Nobel Prize laureate Professor Joseph Stiglitz also said the stimulus “served Australia well“.

Without this stimulus, as the world was sinking into a crisis, growth

in Australia would have stalled and unemployment would have spiked

above 8% leading to a prolonged period of economic hardship for many

Australians.

Australia chose to support jobs and growth and to maintain levels of

spending in order to support services for the Australian people.

To maintain surpluses over the GFC period – as some in the Coalition seem to suggest Labor should have done – would have been irresponsible.

The

Liberal Party’s attempt at a counter graphic with no mention of the

context of the GFC or that $150B is close to the amount tax receipts

have dropped off.

Liberal Party’s attempt at a counter graphic with no mention of the

context of the GFC or that $150B is close to the amount tax receipts

have dropped off.

It would have led to the requirement to unleash austerity on all

Australians at the worst possible time in the last 80 or so years since

the Great Depression.

Cuts would have been in the realm of $32 billion a year over the last five years. That is 2% of GDP annually, in today’s terms.

This kind of program would have put Campbell Newman to shame and led to further hurt in the Australian community.

The other major contributor to our debt position is the $37.5 billion

investment in the NBN. Broadband was an area Howard neglected for his

entire term in office.

He didn’t understand that this expenditure is an investment in our

future; an asset, not an expense. It will create jobs and growth.

Tony Abbott admits he doesn’t understand broadband either:

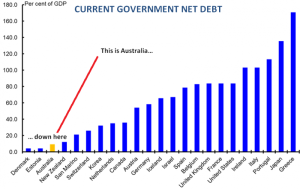

The remainder of our gross debt is about $50.5 billion over five years. This is equal to 0.6% of GDP each year in today’s terms.

The numbers sound big, but in the context of our almost $1.6T

trillion economy, they are small. The Coalition try to take interest

payments and debt out of the wider context because they are large by

historical standards. However, to do this without reference to the wider

economy, the global scenario and the GFC is just plain deceptive.

They know it too.

I ask you to look at how much debt you personally carry on credit

cards and in car and home loans. I can tell you right now it will be

more than 10% of your household income (on a net basis). In fact, private debt is a much greater issue than public debt.

Respected economist Stephen Koukoulas called out the scare campaign recently in an e-mail to Labor members and supporters.

Australia has a AAA credit rating from all three major ratings

agencies. If we were in such a bad fiscal state we would not only not be

one of only seven countries with that honour but we wouldn’t be the

only one with a Stable rating from all three. Under Howard and

Costello’s so called “Golden Age” this was never achieved and to do it during such turmoil must be acknowledged.

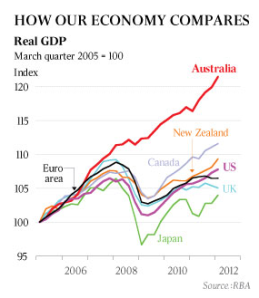

Another

graphic showing the growth in the Australian economy compared to

others. Now at somewhere in the range of 15% since the GFC. (Courtesy of

Independent Australia).

graphic showing the growth in the Australian economy compared to

others. Now at somewhere in the range of 15% since the GFC. (Courtesy of

Independent Australia).

This was only recently reinforced by Fitch when they affirmed their AAA rating for our economy.

A point only further underlined by Dun and Bradstreet’s recent release entitled Australian economy ranked among world’s safest, in which it says:

Solid GDP growth, relative to other

developed economies, contributes to Australia’s status as one of the

world’s safest trade destinations. Likewise, the nation’s unemployment

rate is low, and its annual average inflation remains within the Reserve

Bank’s target band. Terms of trade at historical highs and solid

commodity prices have also helped Australia avoid much of the turbulence

experienced within other advanced economies.

It continues:

Australia’s relative economic strength,

which is supported by the country’s mining boom, and its comparatively

limited exposure to European markets are key reasons for the nation’s

ranking as one of the most attractive trade and investment destinations

globally.

This is the reality Tony Abbott and the Coalition want hidden from

view. However just because you repeat it, getting louder and louder each

time, doesn’t make it true.

Abbott’s deceptions and flat out lies on the economy are even more

mind blowing when one considers he was a Rhodes scholar at Oxford and

studied, of all things, economics at the University of Sydney during

which he commenced his much fabled entry into student politics.

Former Treasurer Peter Costello has himself, in private conversations, been reported as calling the man that wants be our Prime Minister an “economic illiterate.”

Time we got real.

This government has to invest in your future, your jobs and your country.

The alternative is too horrible to contemplate.

Just ask Queenslanders.

(NB: This article rounds our gross debt up to $300B. So in fact our position is currently actually better than presented).

This article was first published on Independent Australia.

No comments:

Post a Comment